OTCQB:FDCT

THE MARKET SIZE

FX IS $6.6 TRILLION PER DAY

CRYPTO MARKET IS $2.0 TRILLION

GLOBAL ADVICE MARKET IS $4.5 BILLION

MARKET PLACE

EXPENSIVE & COMPLICATED

The development of a proprietary multi-asset trading platform is complicated & expensive. Robinhood spent close to $176 million in development and marketing at the launch. Several legacy financial companies license from off-the-shelf software providers thus offering identical trading experiences and increasing the potential for errors.

BUSINESS CHALLENGES

Legacy financial companies face challenges in wining the digital race, expanding digital customer base, increasing profits while decreasing costs, going to market fast with new fintech offerings, reducing operational risks, and maintaining regulatory compliance.

TECHNOLOGY CHALLENGES

Legacy financial companies need infrastructure modernization, rapid implementation of digital fintech capabilities, unique end-user experiences, minimize technical errors, and expertise in development of future-proof fintech solutions.

END-USER EXPERIENCES

End-users of legacy financial companies expect to trade multi-assets from a single account, gamified user-experience, mobility, analytics, data quality and integrity, speed, accuracy, and security.

FDC is led by a team with in-depth knowledge of building successful FX broker businesses.

The Company has developed over 8 million codes with 15+ years of fintech software development, including a multi-asset margin trading platform for FX/Crypto/Stock/ETF, risk management, back-office, pricing/liquidity hub, and other fintech solutions.

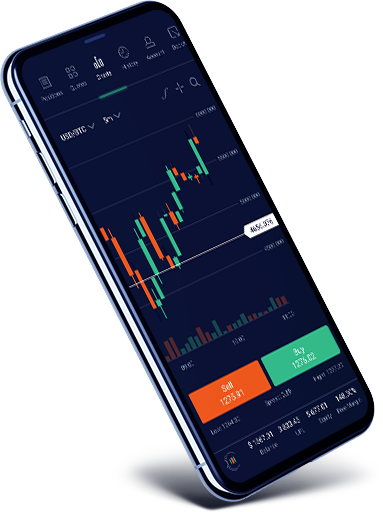

Condor Multi-Asset Pro

A fully customizable multi-asset trading platform, back-office, CRM, and brokerage Software Solutions to legacy financial companies.

Dedicated Support

FDC develops all components of technology infrastructure in-house and assigns a dedicated team and a senior developer to each client.

One-Stop-Technology

FDC offers a full suite of multi-asset trading technology infrastructure and Software Solutions at a competitive price.

License or Own

Through the sale of basic source code, legacy financial companies can customize and brand the platform as a proprietary offering.

ABOUT FDCTECH, INC.

OTCQB: FDCT

SENIOR MANAGEMENT

Fintech & Business Development

CAPITALIZATION

Market Cap

REVENUE MODEL

Technology, Software, and Consulting

SHARE STRUCTURE

Common & Preferred

SERVICE PROVIDERS

Support Team

Transfer Agent: Globex Transfer, LLC

Counsel: William B. Barnett, Esq., Barnett & Linn

CONDOR MULTI-ASSET PRO

DEVELOPMENT

LIQUIDITY HUB

Ours is an exceptional Company with an extraordinary team of industry experts and a promising future. To be sure, our brightest days are before us; we look to execute our go-to-market strategies, seek strategic acquisitions, build industry partnerships, and increase shareholder value.

LICENSING AGREEMENTS

We are aggressively signing licensing agreements and onboarding brokers to our trading platform.

VOLUME BASED FEES

We have tested and integrated Condor Multi-Asset Pro to several liquidity hubs in the FX and Crypto markets where we expect to earn volume-based fees.

VERTICAL INTEGRATION

We are actively seeking acquisition opportunities to acquire, integrate, transform, and scale small to medium size legacy financial services companies.

2021 & BEYOND

The Company expects to lauch a simplified and gamified Condor For All platform for US and non-US brokerages by Q1/22 and Robo Advice Platform for the Australian market in Q2/22.